Fascination About Offshore Trust Services

Wiki Article

The 8-Second Trick For Offshore Trust Services

Table of ContentsThe 3-Minute Rule for Offshore Trust ServicesHow Offshore Trust Services can Save You Time, Stress, and Money.Fascination About Offshore Trust ServicesOffshore Trust Services for DummiesHow Offshore Trust Services can Save You Time, Stress, and Money.About Offshore Trust ServicesThe Ultimate Guide To Offshore Trust ServicesFacts About Offshore Trust Services Revealed

Exclusive financial institutions, also bigger personal corporations, are a lot more amendable to settle collections versus borrowers with complex and reliable asset security plans. There is no property security strategy that can discourage a very motivated creditor with unrestricted money and also perseverance, however a properly designed overseas count on typically gives the borrower a beneficial negotiation.Trustee companies bill annual fees in the variety of $1,000 to $5,000 each year plus hourly rates for added solutions. Offshore depends on are not for every person. For the majority of people living in Florida, a domestic asset security strategy will certainly be as reliable for a lot less money. However for some individuals facing tough lender issues, the offshore count on is the very best alternative to safeguard a significant amount of assets.

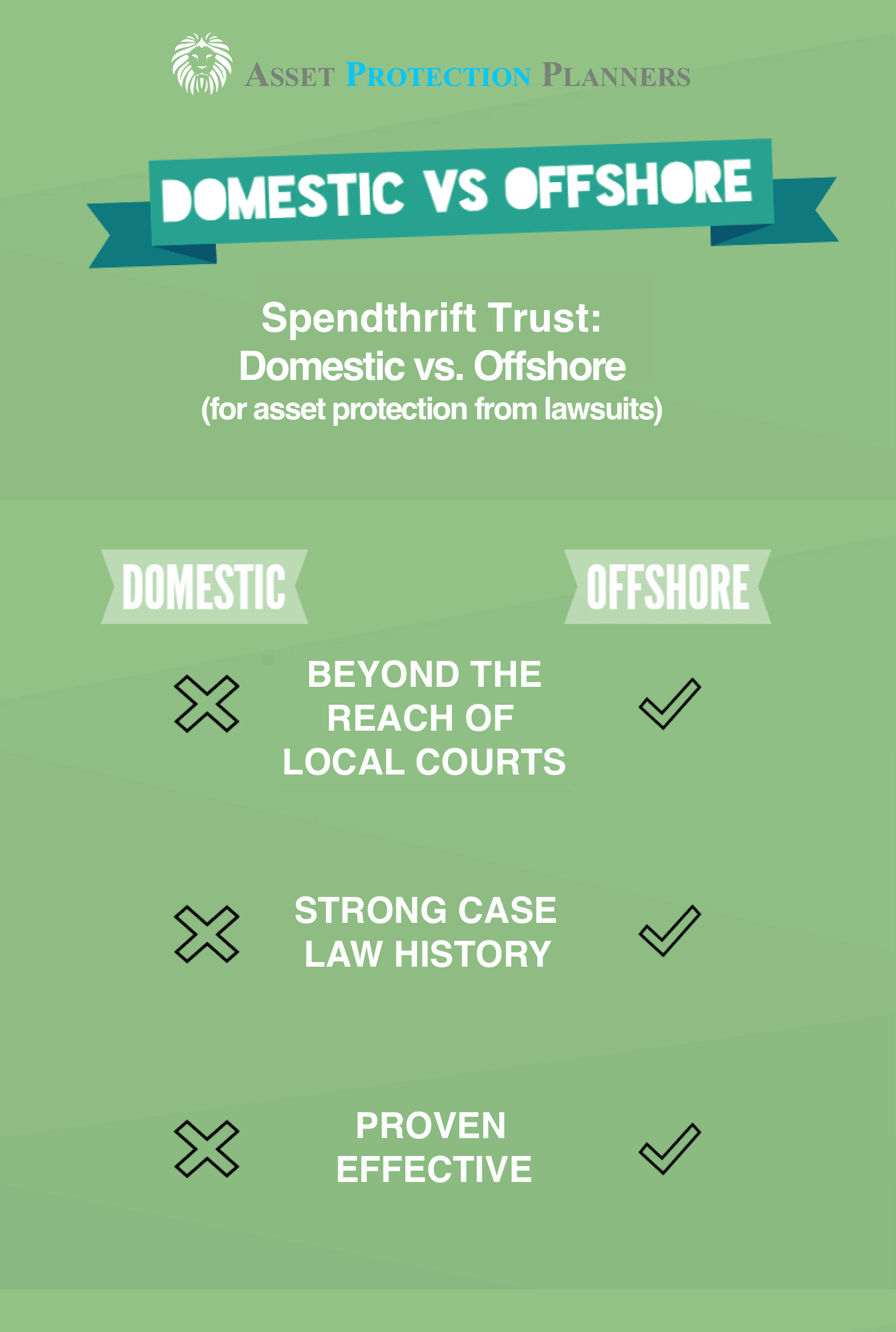

Borrowers might have much more success with an offshore trust fund plan in state court than in a bankruptcy court. Judgment lenders in state court litigation may be frightened by overseas property protection depends on and may not seek collection of possessions in the hands of an offshore trustee. State courts lack jurisdiction over overseas trustees, which indicates that state courts have actually restricted remedies to order compliance with court orders.

The Definitive Guide for Offshore Trust Services

A personal bankruptcy debtor should give up all their possessions and lawful rate of interests in building any place held to the bankruptcy trustee. A United state insolvency judge may urge the personal bankruptcy debtor to do whatever is required to transform over to the bankruptcy trustee all the debtor's assets throughout the world, consisting of the debtor's advantageous rate of interest in an offshore count on.Offshore possession defense counts on are less reliable versus Internal revenue service collection, criminal restitution judgments, and household sustain responsibilities. The courts may attempt to urge a trustmaker to liquify a count on or bring back depend on possessions.

The trustmaker must agree to quit lawful rights and also control over their trust fund possessions for an overseas trust fund to effectively safeguard these assets from united state judgments. 6. Choice of a specialist as well as reliable trustee that will protect an overseas count on is more vital than selecting an offshore depend on jurisdiction.

The Best Guide To Offshore Trust Services

Each of these countries has trust statutes that agree with for overseas possession defense. There are refined lawful differences among offshore trust fund jurisdictions' laws, yet they have a lot more features in common. The trustmaker's option of nation depends mainly on where the trustmaker really feels most comfy putting assets. Tax obligation therapy of international offshore trust funds is very specialized.

An overseas trust fund is a conventional depend on that is developed under the laws of an offshore jurisdiction. Generally offshore trust funds are similar in nature as well as effect to their onshore equivalents; they entail a settlor transferring (or 'resolving') assets (the 'trust fund property') on the trustees to manage for the advantage of an individual, class or persons (the 'beneficiaries') or, occasionally, an abstract purpose.

Liechtenstein, a civil jurisdiction which is sometimes taken into consideration to be offshore, has synthetically imported the count on concept from common law jurisdictions by statute. Authorities stats on trust funds are hard to come by as in most offshore territories (as well as in a lot of onshore territories), trust funds are not required to be signed up, however, it is assumed that one of the most common use offshore trusts is as component of the tax obligation as well as economic preparation of rich individuals as well as their families.

Offshore Trust Services Fundamentals Explained

In an Irrevocable Offshore Trust fund may not be altered or liquidated by the settlor. An enables the trustee to choose on the distribution of revenues for different classes of beneficiaries. In a Fixed trust, the circulation of revenue to the recipients is repaired and also can not be altered by trustee.Privacy and also privacy: Despite the truth that an overseas trust is officially registered in the government, the celebrations of the count on, assets, and the problems of the count on are not recorded in browse around this site the register. Tax-exempt status: Possessions that are moved to an overseas depend on (in a tax-exempt overseas area) are not strained either when transferred to the depend on, or when moved or redistributed to the recipients.

The Definitive Guide for Offshore Trust Services

This has additionally been done in a number of U.S. states., after that the trustees must take a favorable role in the affairs on the firm., but continues to be component of trust law in many common legislation jurisdictions.Paradoxically, these specialised forms of counts on seem to rarely be used in connection to their original designated uses.

An overseas trust is a tool used for asset defense and also estate preparation that works by moving assets right into the control of a lawful entity based in one more nation. Offshore trust funds are irrevocable, so count on owners can not recover ownership of moved properties. They are likewise made complex and pricey. Nonetheless, for individuals with greater responsibility worries, offshore trust funds can provide protection as well as higher personal privacy in addition to some tax benefits.

The smart Trick of Offshore Trust Services That Nobody is Talking About

Being offshore includes a layer of security and also privacy in addition to the capacity to take care of tax obligations. Since the trusts are not located in the United States, they do not have to adhere to United state laws or the judgments of United state courts. This makes it much more hard for creditors and litigants to pursue claims against possessions kept in overseas trust funds.It can be difficult for 3rd parties to identify the properties and proprietors of overseas counts on, that makes them aid to personal privacy. In order to establish an offshore count on, the very first step is to select a foreign country in which to find the trusts. Some This Site prominent places include Belize, the Chef Islands, Nevis and also Luxembourg.

The Ultimate Guide To Offshore Trust Services

Move the properties that are to be safeguarded right into the count on. Depend on proprietors may initially develop a minimal responsibility company (LLC), transfer properties to the LLC and after that transfer the LLC to the depend on. Offshore trusts can be helpful for estate preparation and possession protection yet they have limitations.Profits by assets put in an overseas count on are cost-free of United state taxes. United state owners of offshore counts on additionally have to submit reports with the Internal Income Solution.

Offshore Trust Services Can Be Fun For Everyone

Corruption can be a problem in some countries. Additionally, it is very important to select a nation that is not most likely to experience political agitation, routine modification, financial upheaval or fast changes to tax obligation plans that might make an overseas trust much less useful. Finally, asset protection trusts usually need to be established prior to they are required - offshore trust services.They also do not flawlessly secure against all cases and might subject proprietors to dangers of corruption and political instability in the host countries. Offshore depends on are handy estate planning and asset protection devices. Understanding the correct time to make use of a details count on, and also which trust would supply one of the most benefit, can be complicated.

Take into consideration utilizing our resource on the depends on you can use to benefit your estate planning., i, Stock. com/scyther5, i, Stock. com/Andrii Dodonov. An Offshore Count on is a popular Count on formed under the regulations of nil (or reduced) tax obligation International Offshore Financial. A Trust fund is an authorized tactical plan (comparable to a contract) where one individual (called the "Trustee") in line with a succeeding person (called the "Settlor") grant acknowledge and hold the residential or commercial property to aid different individuals (called the "Recipients").

Report this wiki page